Brazilian foreign trade has always been very important to the Brazilian economy, even more so in recent years with government incentives to promote exports.

You cannot enter this world without a bill of lading.

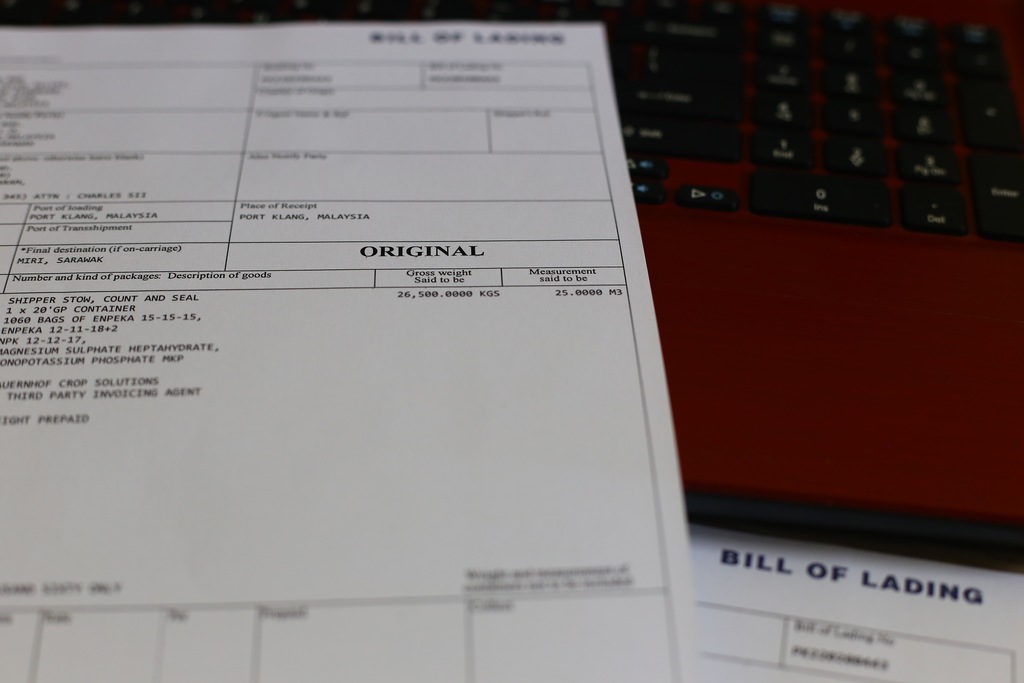

There are several documents used in import and export, and one of them is the bill of lading, without which the products will not leave the ports.

In other words, all merchandise that must be sent from one point to another must be accompanied by documentation that identifies the sender, destination, and other important characteristics for identifying the cargo.

Many of these items are present in the bill of lading.

So, come and learn everything about the importance and how to issue the bill of lading for your company to operate in foreign trade.

Happy reading.

What is a bill of lading?

A bill of lading is one of the documents that must be issued by the carrier involved in the import or export process of products, and it is one of the most important for validating operations.

In English, the term is known as a bill of lading, and since we are talking about international trade, it is essential to also know the term in the language that is most commonly used.

In practice, they are always very similar, because the bill of lading basically needs to list in a technical way some data that will identify the cargo, even so that there can be a check upon loading and unloading.

Main purposes of the bill of lading

It is one of the mandatory and fundamental documents for the process of marketing international goods, and fulfills some very specific purposes for the procedures.

We can divide the bill of lading into 3 main functions, and what are they?

Acknowledgement that the goods have been loaded

List the evidence of the transportation and freight contract term

Inform the properties of the goods

These 3 purposes will be in the bills of lading, in various modes, and can also be supplemented with other information that will assist in the customs clearance of your cargo.

Types of Bill of Lading

Although it is a document that covers the 3 purposes mentioned above and has a standard for completion and application, each mode of transportation will require a bill of lading with certain specificities.

In fact, depending on the mode, it may even appear with another nomenclature, so be very careful not to get confused when issuing and filling out the documentation.

The best way is always to seek some kind of advice from a company that specializes in foreign trade.

Follow us as we explain each type of bill of lading in more detail so you don’t get lost in the import and export process.

Road – CRT (Bill of Lading)

The CRT is the document that must be carried so that cargo can be transported by road between countries.

With this document in hand, the cargo will be cleared through customs at the customs offices of the destination countries that are signatories to the Agreement on International Land Transport (ATIT).

This type of bill of lading is issued in 3 original copies, one of which remains with the carrier, another with the buyer and a third always accompanies the cargo for customs clearance in the countries.

Maritime – BL (Bill of Lading)

This is the most widely used bill of lading, after all, it is the mode that represents more than 80% of all trade in the world, due to the numerous facilities that this type of transport allows, with several different vessels as we have already discussed here.

You can also find this document under the name “bill of lading” or just by the acronym BL, and it is what will allow your cargo to be released at the port of the recipient country.

Air – AWB (Airway Bill); MAWB (Master Airway Bill); HAWB (House Airway Bill)

The air mode is not as widely used as the sea mode, mainly because we are talking about a much more expensive mode, but it speeds up deliveries a lot and can be interesting for some specific types of product.

For this type of transport, the air bill of lading is also called AWB (Airway Bill), and is issued by the airline that is in control of the logistics of the merchandise.

The other versions are MAWB (Master Airway Bill) and HAWB (House Airway Bill) which will cover situations for specific goods and transport conditions.

Rail – TIF/CTF (Railway Bill of Lading)

For rail transport, the bill of lading is called TIF and is used for the transit of cargo and people between countries that are signatories to the international agreement.

Multimodal – (Throughbill of Lading)

The multimodal bill of lading, as the name suggests, is one that covers several modes of transport, but it is not exactly a wild card that can be used for any type of transport.

In fact, it is a document that covers several stages of the goods’ journey, that is, for road cargo that needs to be transported by boat from a certain point, the multimodal bill of lading is used.

Important information about the Bill of Lading

You have already seen that the bill of lading is mandatory and has a standard to be followed, so some information is essential to validate the document.

The essential data for the various modes of transport are:

Type and quantity of items shipped, including description of the merchandise and tax classification, gross and net weight, dimensions and cubic capacity of the volumes

Full name and address of the parties (exporter, importer and consignee)

Place of shipment (origin) and unloading (destination), such as ports and airports

Data on the means of transport (airplane, ship, etc.)

Value and form of payment for freight

The importance of the bill of lading for logistics

Without the bill of lading, your cargo will not leave customs, and there is no way to solve this, which is why it is a fundamental document that must always be filled out correctly for each mode of transport used.

For your logistics, it is also important for much more effective planning, which can speed up the delivery or receipt of cargo, including optimizing costs.

The way to do this even more assertively is through the advice of someone who really understands foreign trade. This way, you avoid headaches such as the cost of container demurrage, for example.

Lachmann’s Shipping Agency has national coverage, as well as agents around the world. Everything you need to make your logistics even more efficient and safe can be found here. Learn more!

Completion

Understanding the bill of lading and its practical function in the functioning of the import and export processes, it became clear that your company cannot do without this document and cannot do it in any way.

Always fill in the data correctly, and seek assistance from foreign trade professionals to help you understand which modes may be most suitable for your operation, and thus optimize the transport and costs.

Count on Lachmann to have an experienced partner in this and other documentation.

How long does customs clearance take: everything in detail

Boosting a company’s revenue can be done in several ways, among them, importing, when well applied can be very positive, but this will depend on how long customs clearance takes.

Basically, customs clearance is how long it takes for customs inspectors to give the go-ahead for your cargo to leave the port and go to your warehouse, and this point is important for the financial success of an import process.

So, to clear up the main doubts on the subject, we have prepared this article so that you can benefit from importing in your company, and learn how to reduce or optimize the customs clearance time for your international purchases.

Enjoy the read!

The importance of understanding the procedures for how long customs clearance takes

Cargo stored in port warehouses demonstrating the importance of customs clearance

To understand how this clearance time works, we must first talk about what customs clearance is, which is one of the fundamental operations in foreign trade, but in imports it is even more bureaucratic.

In this process, the inspection agencies will have the task of verifying whether the cargo that will be unloaded in national territory is regular, that is, whether it does not pose any danger to the country or even whether there is possible smuggling.

This is done by checking the documents involved in the import process, especially those declared by the exporter to confirm whether the incoming cargo has been duly validated.

If the information is correct with that in the documentation, your cargo is considered legal and, according to the Federal Government, will be ready for sale in national territory.

Understand how the customs clearance process works

Cargo containers at a port demonstrating how customs clearance works

The step-by-step process for importing is long and customs clearance is just the final stage of this process, which is when the inspection agencies will give the final approval for the goods to actually enter the country.

Remember that while the customs clearance process is underway, your cargo is stored at the port and this has a high cost, so the longer this clearance takes, the more expensive it will be for the importer.

We have very complete content about customs clearance right here on the blog, but we will provide a summary here.

Basically, customs clearance is a legal process to ensure that imported products entering Brazil are regularized. The inspection may go through several government agencies depending on the nature of the shipment, and this also influences the clearance time.

That is why with good advice from a company specialized in foreign trade, it is possible to plan the steps of an import and prepare the appropriate documentation to reduce this clearance time.

Documents to have on hand for customs clearance

The main documents you will need to have on hand to optimize the customs clearance time are the following:

DI – Import Declaration

This is an electronic document containing all the information regarding the imported goods.

Cargo volume, type of transport, weight and other information

NFE – Entry Invoice

The importer issues this document after the cargo arrives in the country and it is important for accounting records involving the operation.

ICMS Guide

This guide is proof of payment of the ICMS tax, which is levied on the circulation of goods and services. Therefore, it is a mandatory tax after an import process, except in cases where there is some type of exemption or special customs regime.

GLME – Guide for Release of Foreign Goods without Proof of ICMS Payment

In cases where there is no ICMS payment, it is necessary to fill out the GLME to regularize the entry of the goods.

Import Proof

One of the last steps is the import proof that proves all the information indicated in the Siscomex record, thus being the final documentation for customs clearance.

Commercial invoice

Also called Invoice, the commercial invoice is an international document, equivalent to the Brazilian tax invoice.

The commercial invoice is better known by the English term Invoice, and is the international document that functions as a tax invoice.

Because it contains all the information relevant to the negotiation, it is required in the customs clearance process.

Packing list

This document is a list of information about the cargo itself, such as dimensions, volume, gross and net weights, and anything else that is relevant.

It is not exactly a mandatory document, but it is a list that greatly speeds up the customs clearance process.

Bill of lading

We mentioned the bill of lading in a more complete article here, it is worth checking out, but basically it is the document that contains important data about the transport operations.

Certificate of origin

This document is also mandatory for customs clearance and proves the origin of the goods.

However, it is the exporter’s responsibility to issue this document, as it will go through the customs of the country of origin.

Other documents such as the cargo manifest, which is important for moving cargo within the country, and the import license, which although not mandatory, can be requested and helps with more assertive customs clearance.

These documents may vary depending on the type of import itself, but in general they are the main steps involved in customs clearance.

So, how long does customs clearance take?

If there are no discrepancies in these documents that we mentioned, customs clearance takes at least 8 days to be completed.

Remember that this will depend on how many agencies will inspect your imported goods, so it is important to have professional advice to avoid taking longer than necessary.

Cargo ship showing the summary of customs clearance

Summary of official information on customs clearance deadlines

According to the information available on the Federal Revenue website, customs clearance upon import is the verification of all stages to ensure that the process was carried out in accordance with customs regulations, so all inspections must be carried out by an official agent on site.

Once all the documentation mentioned above has been presented and is in accordance with the legislation, clearance should occur without any major problems within an average period of 8 calendar days.

The specific data for each type of product can be found on the Federal Revenue website.

Importer’s responsibility regarding how long customs clearance takes

A recent study conducted by the Brazilian Federal Revenue Service using the World Customs Organization methodology has shown that delays in customs clearance are caused by the importer in most cases.

The surveys were very comprehensive, but what we can highlight is that importers’ lack of knowledge causes them to neglect documents and steps, which results in longer clearance times.

To counter this, the automation of some processes and advice from companies experienced in importing can help optimize clearance times.

Lachmann Bonded Warehousing are a reference in storage management and integrated logistics of goods. Click to check out all the information!

Completion

Finally, you have discovered how long customs clearance takes and how much of that time can be optimized to make your import more efficient in terms of both clearance time and storage costs.

To be truly assertive in this process, learn about Lachmann’s solutions for more efficient customs logistics.